FAQs About Insurance Coverage for Sleep Studies, CPAP and Supplies

Insurance policies have three main components:

- Copay: The amount that you are responsible for paying yourself, as mandated by your insurance contract, to have a sleep study or other services.

- Deductible: This is the total amount that the patient needs to pay initially out of pocket before the insurance company makes any payments for medical services. For instance, if your insurance plan has a $1000 deductible per year, you have to pay this amount in full before your insurance company starts to contribute.

- Co-insurance: Some insurances have a co-insurance instead of/in addition to a deductible. This means that the patient is responsible for a percentage of the fees of the medical services. For instance, if your insurance plan has a 20% co-insurance, this means that your insurance will make you responsible for 20% of the fees and they will pay the rest. This is usually after the deductible has been met.

- Out-of-pocket Maximum: The most you’ll have to pay during a policy period (usually a year) for services. Once you’ve reached your out-of-pocket max, your plan begins to pay 100% of the allowed amount for covered services.

Download our Guide to Understanding Your Health Insurance.

Most insurances (HMO, PPO and Medicare) cover sleep studies and PAP therapy for the treatment of sleep disorders. Plans may vary in their coverage (see below: rental versus purchase for PAP device set-ups and in-center denied for in-home sleep testing) and many now require authorization for these services.

It is important to understand your benefits. As a courtesy, we will verify your insurance benefits and request authorization, as needed.

We understand that patients and their physicians are concerned about rising out-of-pocket expenses for health care; unfortunately, this often affects decisions about how healthcare is administered. By contracting as an in-network provider with more payer organizations, more patients can afford to receive the proper diagnosis and treatment for their sleep disorders.

We are contracted with all major PPO plans, Medicare and many HMO plans in California.

Based on your insurance coverage, you may have a copay for your sleep study, PAP device set-up or replacement supply order. If this is the case, we will let you know at the time of service (for supply orders we will send you a statement once we receive the explanation of benefits after your claim is processed by your insurance company) and collect your payment.

Please note that we are an outpatient facility (not a hospital).

Some insurance companies are now denying requests for in-center sleep studies and approving in-home studies (HST) instead. Typically, they will deny a request for in-center testing if there are no significant medical issues and it is highly likely that the patient has moderate to severe sleep apnea.

Home Sleep Testing (HST) can be used exclusively to diagnose or rule out Obstructive Sleep Apnea (OSA). Because of this, it should only be recommended by a doctor if it is highly likely that the patient has moderate to severe sleep apnea, and if the patient has no other significant medical issues such as pulmonary diseases, neuromuscular disease or congestive heart failure. Home sleep studies cannot performed on children and cannot diagnose other sleep disorders such as restless leg syndrome, periodic limb movement disorder or narcolepsy. These patients should be tested in a sleep center. Source: Clinical Guidelines for the Use of Unattended Portable Monitors in the Diagnosis of Obstructive sleep Apnea in Adult Patients. JCSM Journal of Clinical Sleep Medicine, Vol. 3, No. 7, 2007

Many insurance companies now pay for PAP devices on a monthly rental basis, typically 4 to 10 months. At the end of this period you will own the device. Because it is a monthly rental, we will bill your insurance company monthly. If you have a co-insurance, you will also be billed monthly.

Compliance guidelines:

Most insurance compliance guidelines require that you show proof of using your device for a minimum of 4 hours per day at least 22 days out of a consecutive 30 day period within the preceding 90 days (in the past 3 months).

Many insurance companies are now requiring proof that you are compliant (using your PAP device most nights) before they will authorize your next order of replacement supplies. New PAP devices may include a wireless modem which can transmit data to your physician, supply company (like us) or even your insurance company. Older devices have a memory card that must be removed and the data downloaded.

Sleep studies:

Home sleep testing (HST): 95806, G0398 or G0399 depending on the insurance company and type of device used.

In-center polysomnography (PSG): 95810 (95782 for children under 6 years old)

Split night or 50/50 study, PAP titration study: 95811

Multiple Sleep Latency Test (MSLT): 95805

Click here for a comprehensive guide listing common study types, reasons for testing and CPT codes.

PAP device and supplies:

Continuous PAP (CPAP) or auto set PAP (APAP): E0601

Bilevel PAP (BiPAP): E0470

Bilevel with pressure support (ASV): E0471

Heated humidifier: E0562

Waterchamber: A7046

Mask* (nasal or nasal pillows): A7034 Full-face mask: A7030 Headgear: A7035 Chinstrap: A7036

Nasal mask cushion: A7032 Nasal pillows cushion: A7031 Full-face mask interface: A7033

Disposable filters: A7038

Tubing: A7037 Heated tubing: A4604

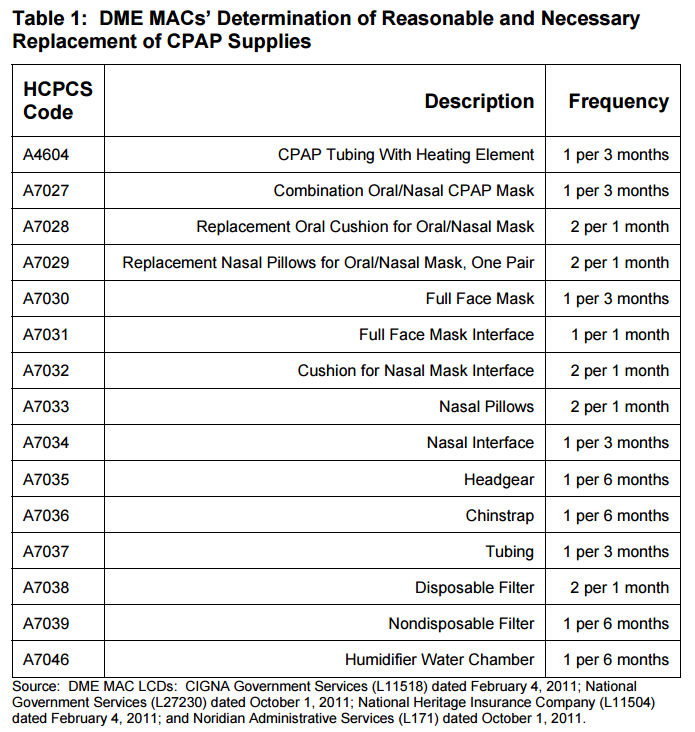

Many insurance plans follow the guidelines from Medicare for regular replacement of supplies. You can review the guidelines online at http://oig.hhs.gov/oei/reports/oei-07-12-00250.pdf. Medicare guidelines suggest replacing your supplies at the following frequency*:

*Your particular insurance plan may have a different allowance for replacement supplies. This is why we will verify your coverage to determine your allowance before processing your order. You may purchase additional replacement supplies at our cash prices if you would like more supplies than your plan allows.

Many insurance companies will cover a new device every three to five years. You may also need a new sleep study before your insurance company will authorize the new device. The insurance companies want to make sure that you still need the device and that your current settings are appropriate. Due to weight loss or gain or other changes to your health, you may require a higher or lower pressure setting. Read “How Often Can I Get a New CPAP Machine” here.

Many insurance companies now pay for PAP devices on a monthly rental basis, typically 3 to 10 months. At the end of this period you will own the device. Because it is a monthly rental, your provider will bill your insurance company monthly. If you have a co-insurance, you will also be billed monthly (to learn more about the difference between co-insurance, co-pay, deductible and more insurance terms, check out our Guide to Understanding Your Health Insurance).

The most common options:

- 3 month rental, 4th month purchase (many PPO insurances)

- 10 month rental (most HMO insurance and some PPO insurances)

- 13 month rental (Medicare and other government insurance)

You can either ask your provider or contact your insurance company. When your provider verifies your insurance benefits and coverage they will find out the terms of the rental or purchase and should be able to provide you with an estimate of your expected financial responsibility at the time of set-up and monthly for the term of your rental. Unfortunately, patients and providers have no control over whether CPAP is covered as rental or purchase.

If your provider is in-network, they have negotiated rates with your insurance company for your PAP device. There may be a big difference between what you pay if you go with a provider that is in-network rather than one that accepts your insurance, but is not in-network (click here to learn more about the difference and what it means to patients). The cost also varies by type of device. A CPAP or APAP will cost less than a BiPAP or bi-level device (click here to learn more about different types of PAP devices).

At the time of your set-up you will also receive a mask, tubing, filters and cushions that will need to be replaced in the future. It’s best to speak with your provider or contact your insurance to get the actual price.

We offer CPAPs and supplies at cash rates in our online store; however, the rates paid by insurance companies are usually much lower.

Typically, the rental charges are determined by dividing the purchase price of the device by the number of months in the rental term. Read “How much will I pay for a purchase?” above to learn more about purchase costs.

It’s important to remember that your first month’s bill will include the purchase of the mask, tubing, filters and cushions that were provided during your set-up. You will be charged for those items for future rental months, only when you order additional replacement supplies, usually every three months.

If you schedule a face-to-face set-up or order a CPAP online with us, we can verify your insurance and tell you how much it will cost.